When Will Gulfport Stock Rise Again

Gulfport Energy Corporation'south (NYSE:GPOR) Ch.11 reorganization programme will leave the newly reorganized visitor notwithstanding highly leverage when they exit bankruptcy and are merely reducing the current debt of $2.four billion by $1.two billion. The plan indicates that they will have a $580 million exit facility, $550 million in new unsecured notes, and $55 one thousand thousand in preferred stock. With too much leverage they could be back in defalcation court again. Electric current Gulfport shareholders, as expected, are getting no recovery and the stock should exist sold.

Ch.11 Reorganization Plan

A copy of the proposed Ch.11 reorganization plan can be institute in Hicks' Declaration (docket forty Exhibit B, starting on page xc of 399 pages). At the time of writing this commodity I have not seen a filing for a disclosure statement. Hicks' Declaration also includes the term sheets for the new preferred stock (Exhibit H, page 395 of 399 pages) and unsecured notes (Exhibit I, page 397 of 399).

Current Gulfport Energy Shareholder Recovery (Class 7)

As often happens under Ch.xi reorganization plans, current GPOR shareholders are getting no recovery. Dissimilar another energy companies where creditors are "gifting" token recoveries to shareholders, such equally Oasis Petroleum (OTCPK:OTCPK:OASPQ), there is no gifting to GPOR shareholders. As stated in the reorganization program: "On the Effective Date, all Existing Interests in Gulfport Parent shall be cancelled, released, and extinguished, and will be of no further force or effect." I expect the shares will continue to merchandise on the Pink Sheets until the plan effective engagement, when they will be cancelled.

General Unsecured Claims (Form 4A and Class 4B)

Information technology is interesting to annotation that the full general unsecured claims are divided into two different groups inside Class 4. Class 4A are claims against Gulfport Parent and Class 4B are claims against Gulfport subsidiaries. (A merits holder could have claims against both.) Unsecured notes are included as general unsecured claims and claims resulting from any rejected mid-stream contract would also be included equally a full general unsecured claim. (See below.)

Unsecured noteholders are getting upwardly to a maximum of 94% of the new stock, subject to dilution caused by the management incentive program and conversion of the preferred stock, and an unspecified amount of eight% 5-year unsecured notes. The remaining 6%, assuming the maximum of 94% is given to noteholders, would be given to the other general unsecured claim holders. They are issuing a total of $550 million new unsecured notes, simply information technology is unclear the amount that volition be issued to a specific type of general unsecured claim.

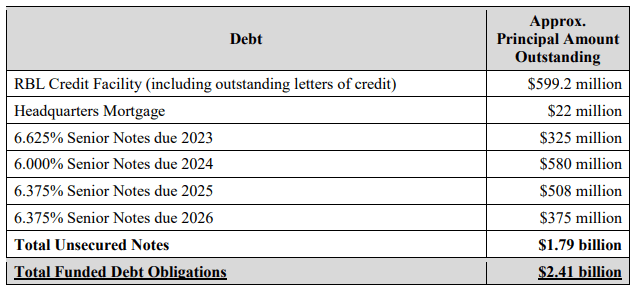

Source: Docket 40

Class 4 is as well getting the right to participate in a $fifty million convertible preferred stock. Again at that place are no specifics regarding allotment of these rights.

A major trouble with Grade 4 is that is difficult to approximate the total corporeality of claims. At that place is a total amount of $ane.79 billion claim, not including whatever unpaid involvement, for unsecured noteholders, but an unknown corporeality of claims that most likely will ascend from rejected contracts and leases.

Preferred Stock Rights Offering

To enhance $50 million in new cash, Gulfport is including a convertible preferred stock rights offer in their reorganization program. They are actually issuing $55 million because an boosted $5 million is office of the backstop fee. The new preferreds pay ten% if paid in cash and 15% if paid PIK. The conversion stock price is a 30% discount to plan equity value, which has not been disclosed still, only volition be a negotiated number.

Why the Ch.eleven Reorganization Plan Is Irrational

In Ch.11 bankruptcy, many companies endeavour to deleverage their balance canvas as much every bit they can. Under the proposed programme, Gulfport is only modestly deleveraging. They are reducing their pre-petition debt of $ii.41 billion (not including $183 million owed to pre-petition Lender Bandy Counter Parties from hedges) by merely $one.2 billion. Issuing $550 million of 5-twelvemonth unsecured notes is completely irrational. They are non raising $550 million in new cash by this deal-they are simply giving Course 4 unsecured general claim holders a larger recovery packaged. (I exercise not empathise why unsecured claim holders should feel like they are entitled to a larger recovery.)

I can understand why they are rolling over most of their DIP and RBL into an $580 million go out facility, but by issuing $550 1000000 in new notes they will accept about $i.13 billion in debt when the new visitor exits defalcation. This high debt level compares to only $i.35 billion in acquirement for the 12 months ending September 30. In addition, the $55 one thousand thousand in new preferred stock is a very expensive means to raise cash with a xv% PIK payment and a very "dainty" conversion feature.

I expect both RBL merits holders and unsecured noteholders to vote to confirm the program because already 95% of RBL holders support the plan and so do 70% of unsecured noteholders. Because of too much leverage afterwards exiting bankruptcy and potential weakness going forward in the free energy business, Gulfport could exist back in bankruptcy court like Ultra Petroleum. I exercise not, therefore, think that the currently proposed plan is confirmable because it does non run into section 1129((a))(11) requirement:

Confirmation of the plan is not likely to be followed by the liquidation, or the need for further financial reorganization, of the debtor or any successor to the debtor nether the plan, unless such liquidation or reorganization is proposed in the programme.

In another Ch.11 bankruptcy case, I idea CBL & Associates Backdrop (OTCPK:OTCPK:CBLAQ) original RSA was illogical considering they were issuing a big amount of new secured debt as part of the recovery for unsecured noteholders. CBL's new current plan has now eliminated this secured note recovery. In my opinion, Gulfport needs to exercise the same in gild to conform to section 1129((a))(11).

Pipeline Rejections

I take covered the event of rejecting pipeline contracts under section 365 during bankruptcy in many other prior articles on bankrupt energy companies and nosotros have to wait until the Federal Courtroom of Appeals decides on the Ultra Petroleum appeal. This is a turf war between FERC and the bankruptcy courts. The bankruptcy courts take held that they can't grant an exception to right to decline contracts for pipeline contracts-a debtor in Ch.xi bankruptcy has the right to turn down a contract.

Mr. Hicks stated they are planning to file contract rejections in expectation of saving $sixty meg annually in mid-stream costs. Rockies Limited Pipeline, Rover Pipeline, Midship Pipeline, and TC Free energy will most probable be parties to adversarial proceedings over their contracts.

Major Stockholders Sold Recently

There have been some 13D filings recently that bespeak major Gulfport shareholders sold stock in the weeks leading upwards to the bankruptcy filing. Shah Uppercase sold 13,367,867 shares between October 22 and Nov two according to their filing. Firefly Value Partners sold a footling over 19 million shares between October xiii and October xv. They buyers of these shares must have been speculators "hoping" for a "souvenir" under the reorganization plan from a college priority class.

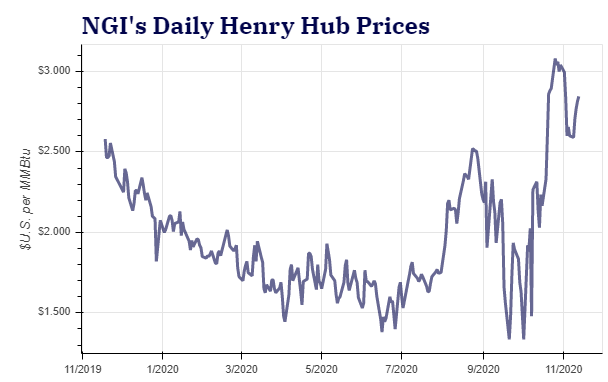

Natural Gas Prices

Since 93% of the revenue for Gulfport comes from natural gas and 6% from natural gas liquids, natural gas price changes are critical to Gulfport.

Natural Gas Spot Price

Source: Natural Gas Intelligence

Conclusion

Many investors were expecting that Gulfport Free energy would file for bankruptcy in order to deleverage and reject costly mid-stream contracts, but I personally was surprised at the proposed Ch.11 reorganization programme. I expected a common stock rights offer to raise greenbacks, but non a very expensive convertible preferred stock one. Plus, I was surprised that the plan includes $550 meg in new unsecured notes. Overall, I call up the plan is irrational considering it does not reduce debt enough.

Shareholders are getting no recovery. There is no "gifting" from higher priority classes. Merely because some other bankruptcy cases give a modest recovery to current shareholders, it still is unusual for shareholders to receive any recovery. Rational investors should not invest on "promise". I rate the GPOR shares a sell. I am withholding whatever recommendation on unsecured notes without knowing more details of their recovery.

Editor's Annotation: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written past

B.A. in Economics; M.S. in Finance. I unremarkably write about distressed companies and companies in Ch.11 bankruptcy. I am semi-retired after spending decades in investments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions inside the next 72 hours. I wrote this article myself, and information technology expresses my own opinions. I am not receiving compensation for information technology (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4389290-gulfport-energys-bankruptcy-reorganization-plan-is-irrational

0 Response to "When Will Gulfport Stock Rise Again"

Post a Comment